Will Diwali Ecommerce Boom Hurt Brickandmortar Retailers?

- Will Diwali Ecommerce Boom Hurt Brick And Mortar Retailers Free

- Will Diwali Ecommerce Boom Hurt Brick And Mortar Retailers Near Me

- Will Diwali Ecommerce Boom Hurt Brick And Mortar Retailers Like

Brick and mortar retailers and wholesalers are getting worse hit by the e-commerce industries and so they are pressurizing various bands to support them for competing with ecommerce websites. Due to increasing growth of e-commerce industries, retail industry is lacking behind because the. With Diwali just days away, and Christmas around the corner, e-commerce companies and retailers alike are jumping up to combat high-volume sales.

Come Diwali, more shoppers than ever will turn to phones and laptops for their gift shopping, as India’s ecommerce growth powers on through the Covid-19 crisis. RedSeer Consulting’s latest report crunches the numbers.

The consulting firm expects festive sales in 2020 to grow by 50% compared to the 2019 festive season – considerably higher than the 30% jump over the previous year. Several factors will contribute to the boom this year, with most revolving around Covid-19 or its widespread repercussions.

“Covid-19 enabled massive growth in new shoppers as consumers now more than ever prefer to shop in a manner that is convenient, safe and hygienic and the e-commerce space meets these requirements,” explained Mrigank Gutgutia, Director of Ecommerce at RedSeer Consulting. According to Gutgutia, the pre-season survey has already shown signs of ecommerce dominance.

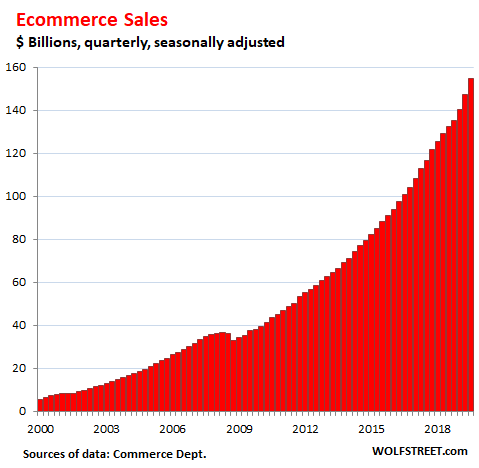

The result is that festive sales this year will likely amount to $4 billion – the highest ever for a festive period. The figures reflect a combination of strong fundamentals and favourable market conditions. Ecommerce in India has already been a bright spot for several years, particularly since 2015 when telecom giant Reliance launched its Jio network.

Through Jio’s cheap data packages, online commerce was suddenly activated among India’s consumer base of more than a billion people. Ecommerce grew at a compound annual growth rate (CAGR) of 25% over 2016 and 2017, and a further 30% over the last two years. By 2019, the market was worth more than $27 billion.

As mentioned, the biggest growth driver was the spread of internet accessibility, from the metropolitan Hindi/English speaking ranks known as India to Bharat – tier two cities and rural areas that commonly speak regional languages. RedSeer reports that the spread of ecommerce from India to Bharat is visible even in the festive sales this year.

In fact, the researchers note that for the first time ever retailers have also acted on this distinction, distributing a number of marketing campaigns and even their sales channels via WhatsApp or other video-based releases. Add to this the concerns around Covid-19 and visiting local shopping centres, and the ecommerce consumer base for this festive season gets a tremendous leg up.

The analysis suggests that up to 50 million people will shop online this festive season. To put this in perspective, that’s a 70% jump from the same time last year, when online shoppers amounted to just under 30 million. Testament to decentralisation efforts is that Tier 2 cities will account for 50% of all online shoppers.

Brick and mortar?

So retailers have been successful in reaching a wider consumer base, although this is a trend born more out of necessity than anything else. Where ecommerce is skyrocketing in India, sales from brick and mortar stores has all but stopped. Those elements within India’s retail sector that were organised have had no choice but to invest in online and omnichannel capabilities to meet consumer needs under Covid-19.

A financial burden in the short term; this scenario might just be a blessing in disguise for retailers in India, setting them up for the digitalised consumer model of the future. Going forth, having an established ecommerce and omnichannel infrastructure will help reach an ever-expanding consumer base in India that is increasingly digitalised.

In fact, the same is true for India's ecommerce landscape as a whole. Uncertainty looms on whether a second lockdown will be necessary in the short term, and if consumers will ever return to pre-pandemic consumption patterns even in the medium to long term. A strong ecommerce landscape will be crucial in this scenario, and the initial months of the pandemic have been a catalyst from this perspective.

Such is the impetus given to ecommerce in India this year that RedSeer Consulting anticipates growth of 40% for the segment for the course of the 2020 commercial year. Online sales amounted to $27 billion by the end of last year, and will likely reach a value of $38 billion by the end of this year according to the report.

Year after year, RedSeer Consulting has been reporting growth in online festive sales, although few reports have portrayed the size and scale of growth as the latest one, which comes amid a bumper year for ecommerce in India and across the world.

Will Diwali Ecommerce Boom Hurt Brick And Mortar Retailers Free

Subscribe to our newsletter.

Will Diwali Ecommerce Boom Hurt Brick And Mortar Retailers Near Me

Will Diwali Ecommerce Boom Hurt Brick And Mortar Retailers Like